Top 10 Tips On Currency Conversion Fees In Terms Currency Exchange Rates And Exchange Rates

Currency conversion charges are critical in the current global economy, no matter if you travel internationally, conduct business abroad, or manage investments in foreign currencies. These charges can be different based on the person providing the service, how the exchange was conducted and the currencies involved. Understanding these fees will allow you to cut costs and make better decisions. The top ten tips regarding currency exchange charges will assist business owners, travelers as well as investors.

1. What are the various types of conversion fees?

The fees for conversion of currency can take on different forms. They may be service fees, transaction fees, or markups for exchange rates. Fees for transactions are set for each change. Service charges may be a % of the amount converted. Rate markups for exchange occur when the provider has rates that are less advantageous than the market. You can find the best options to suit your needs by familiarizing yourself about these types of costs.

2. Compare rates from a variety of providers

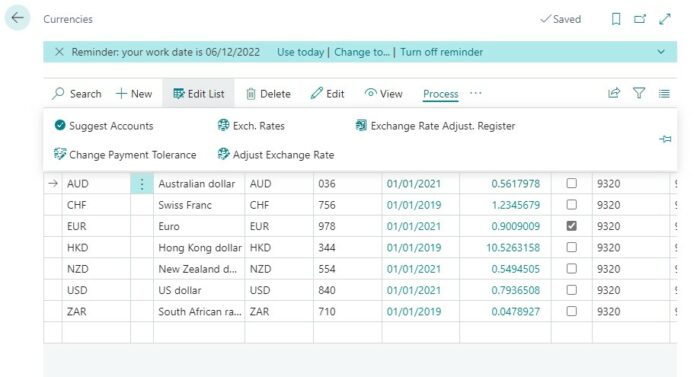

Check rates before you change money. Fee structures and exchange rates can differ between banks, currency kiosks and online platforms. Use tools for currency conversion to check real-time rates and estimate the total cost, which includes charges, for each option. This comparison can be used to help identify the best bargains and could save you lots of money when you exchange huge amounts.

3. Find no-cost Currency Exchange Options

Certain financial institutions and banks offer accounts which allow free currency exchanges, or lower costs for specific transactions. Fintech and online banks are among them. They offer account holders a free exchange of currency. Think about opening a foreign exchange account with this type of institution if you have dealings with foreign currencies are frequently.

4. Be aware of fees for dynamic currency conversion (DCC) costs

You might be offered the option to pay in your own currency when using your debit or credit card overseas. This is known as Dynamic Currency Conversion. It may be convenient, but you will often incur higher conversion fees and receive unfavorable rate of exchange. To avoid extra charges ensure you pay in local currency. This will ensure you get the best exchange rate.

5. No foreign transaction fees on credit cards

You can save money by using credit cards with no charge for foreign transactions while you travel. Many credit cards geared towards travel offer this feature, which allows you to shop abroad without incurring additional costs. It is crucial to select a credit cards that best suits your preferences for travel and has favorable exchange rates.

6. You can withdraw money at ATMs.

– Using ATMs to withdraw cash in local currency will often result in better exchange rates compared to currency exchange kiosks. Keep in mind that both your ATM operator and your bank could charge you fees. Avoid dynamic currency conversion fees by using ATMs that are connected to your bank.

7. Plan your currency conversion in advance

– Avoid last-minute currency exchanges at airports or tourist hotspots which are usually more expensive. Instead prepare your currency conversion in advance to take advantage of lower rates and charges. If you want to save money on urgent travel expenses, you might consider making small exchanges prior to departure. However, it is recommended to plan to exchange greater amounts at more advantageous rates upon arrival.

8. Track the rate of exchange trends

You can determine the ideal moment to convert currencies by watching for any changes to exchange rates. You can determine the timing of your currency conversions by keeping track of the rate of exchange. You can use historical data to inform your choices and make the most of favorable conditions.

9. Include hidden costs to transactions

– Be aware that some companies may charge hidden fees which aren't obvious. There are a variety of fees that could be service charges or maintenance fees for foreign currency accounts, charges, or even unfavorable conversion rates. Always read the fine-print and ask questions in order to fully understand all costs associated with currency conversion. This will help you avoid unexpected charges as well as help you make better decisions.

10. Contact a professional in finance to handle large transactions

Get advice from a financial expert if you have large transactions to make or are involved in complicated transactions involving currency exchanges. Specialists in currency are able to provide insight into best practices in order to maximize transactions and reduce charges for conversion. It is vital for investors or businesses from abroad to be able to control their exposure to foreign currencies.

Utilize these suggestions to help you navigate the complexities of currency exchange, whether you're travelling abroad, doing business overseas or managing foreign currency investments. Understanding the subtleties behind conversion fees will help you make more informed financial decisions that are in line with your personal or business goals. You can save money and improve your financial planning strategies by understanding these subtleties. Read the best currency converter url for site examples including japanese yen to usd, usd to pakistani rupee, pound to usd, us dollar to rmb, pound to usd, yen to us dollar, colombian peso to dollar, usd to peso, euro to dollar, usd to mxn and more.

Tips For Making Payments In The Currency You Choose.

In today's globalized economy, it's vital to choose the best method of payment in order to manage your financial transactions effectively when travelling abroad, managing business or managing investments. The method you choose to use will significantly impact the costs, convenience, as well as security. Payment methods vary with fees, rates of exchange and the degree of acceptance. This could significantly impact the overall experience. Understanding the nuances and differences of payment methods will aid you in making decisions that are in line with your objectives. The following are the top 10 detailed guidelines for selecting and effectively using payment options for your financial situation.

1. Learn about the different payment options available

Learn about the various payment methods like cash debit/credit cards, mobile wallets as well as digital wallets. Each method has its pros and disadvantages with regards to the convenience, cost, and acceptance. Cash, although universally accepted and suitable for smaller transactions, can also be less secure. Knowing the pros and cons of each one can help you select the most appropriate one for your situation.

2. Consider Currency Conversion Charges

If you are using debit or credit cards to make international transactions, be aware of currency conversion fees that may apply. The fees paid by banks and credit cards companies are often very different. Some credit cards charge foreign transaction fees, while others don't. Contact your credit card company or bank before traveling overseas or purchasing items to determine the policies they have regarding charges for currency conversion. Select cards that minimize the cost of these transactions.

3. Use Credit Cards with No Foreign Transaction Costs

If you intend to travel internationally or buy products in foreign currencies, you should choose a card that does not charge transaction costs. Numerous credit cards specifically designed for travel provide this feature, which allows the card to be used when you are in foreign countries without incurring extra costs. This could be a substantial savings, especially for frequent travellers or those who are making major purchases on markets in the foreign market.

4. Make use of mobile payment options to leverage

Mobile payment options like Apple Pay or Google Pay offer a convenient alternative to carrying cash and cards. These options, which typically come with enhanced security features such as biometric or tokenization, are a great choice for offline and online transactions. If mobile payments are available make use of it to streamline your spending.

5. Keep an eye out for ATM fees when withdrawing money

– Take note that ATM fees vary widely. Certain banks charge a fee for international withdrawals, while other banks might partner with local institutions and offer withdrawals at no cost. You can reduce your expenses by looking for ATM networks that charge less charges. You should consider withdrawing more money in one go to reduce the amount of transactions and charges.

6. Plan alternative Payment Methods

It is important to have a backup source of payment in case your primary method fails, or you are unable to use it. If you wish to be sure you have the ability to buy, you should keep an extra credit or debit card as well as cash or a mobile payments option in your. This is particularly important when traveling, as certain locations may not accept all payment methods. If you plan ahead, you will be able to deal with unexpected situations better.

7. Monitor exchange rates to make better choices

When you purchase foreign currencies, be aware of the current exchange rates. This will allow you determine when to convert money or to use your chosen payment method. You can determine the most favorable conditions for currency exchange using applications and tools which monitor rates in real time. This information can help inform your decision on the best payment method to use particularly if you are able to avoid fees associated with conversions.

8. Be aware of security features

When choosing payment options security must be your top consideration. Examine the security features offered by your credit or bank provider. Find options that offer fraud protection, transaction alerts, and encryption technology. If you select secure payment options you will be able to protect yourself from fraudulent and unauthorised risk of transactions. This is crucial when buying online or from overseas countries.

9. Review Payment Policies for Business

– If you are an owner of a company, understanding the policies for payment is vital to managing the flow of cash and customer transactions. Explore different payment processors, and their charges, features, and acceptance rates. Choose a payment option that aligns with your goals. Consider whether you want to prioritize low transaction costs, rapid processing times, and customer ease of use. The best payment method can increase customer satisfaction while streamlining your business.

10. Learn about the different payment options for investment.

For investors, knowing payment methods related to buying or selling assets is essential. Different brokerage platforms provide different payment options when you are funding your account or performing trades. Be sure to be familiar with all the associated charges and timeframes. Also, you should be aware of the implications of leveraging or margin accounts, which could be a major influence on your financial plan overall.

These specific tips will allow you to better navigate the maze of travel, business, and investments. Knowing what options are available, associated fees, and security options will allow you to make more informed choices in your financial life that are compatible with your goals. A reliable payment option will enhance your overall experience and help you save money. Additionally, it will give you peace of mind when it comes to the financial transactions you make. View the best CZK to EUR for blog advice including pesos to usd, usd to aud, usd to british pound, 1 us dollar in indian rupees, usd to british pound, dollar to euro, usdthb, 1 usd in rupees, jpy usd, gpb to usd and more.